Reword

Focus on Personal Finance, Ch. 4

- Describe a deposit type financial institution and a non-deposit type institution that you use. Explain how you use it and why you like or dislike those institutions.

Focus on Personal Finance, Ch. 5

- What is consumer credit? Give an example of an “inexpensive loan” and an “expensive loan.” What actions could be taken if a person gets into financial difficulty as a result of overusing credit, according to Kapoor et al?

Focus on Personal Finance, Ch. 10

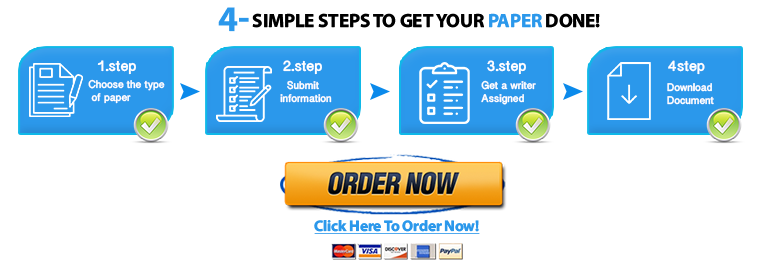

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper NowPlease reword this paragraph in your own words and please do not use the same exact words as in the paragraph.

- 3- Whole-life policies, a type of permanent insurance, combine life coverage with an investment fund. Here, you’re buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company. Cash value builds tax-deferred each year that you keep the policy, and you can borrow against the cash accumulation fund without being taxed. The amount you pay usually doesn’t change throughout the life of the policy. Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of return. To get a higher return, these policies generally don’t guarantee a certain rate. Variable life and variable universal life are permanent policies with an investment fund tied to a stock or bond mutual-fund investment. Returns are not guaranteed. A term policy is straight insurance with no investment component. You’re buying life coverage that lasts for a set period of time provided you pay the monthly premium. Annual-renewable term is purchased year-by-year, although you don’t have to prequalify by showing evidence of good health each year.

Focus on Personal Finance, Ch. 11

Please reword this paragraph in your own words and please do not use the same exact words as in the paragraph.

- 4- In assessing investments such as stock, investors consider the stock’s valuation, strategy, plans for diversification and appetite for risk. Stocks are evaluated in many ways, and most of the common measuring sticks are easily available online or in the print and online versions of The Wall Street Journal. Investors seeking better value seek out stocks paying higher yields than the overall market, but that’s just one consideration for an investor when deciding whether or not to purchase a stock. Picking stocks is much like evaluating any business or company you might consider buying. After all, when you buy a stock, you’re essentially purchasing a stake in a business.

Assessment Activity – Loan Rates

Search for websites that include bank loan rates.

Determine current rates for both a 60-month and a 36-month loan on a new car where the buyer must finance $20,000.

Answer the following questions by clicking on the New Message icon:

- Using the loan calculator, what is the difference in monthly payments between the 60-month loan and the 36-month loan? Review the amortization tables. What is the difference in total interest one would pay over the life of these two loans? What do these differences show you about the true cost of the car?

- 6- If you’re paying 20% interest on your credit card balance and let’s say hypothetically that there is no late penalties, when will the debt balance double according to the “rule of 72”? When would your money double if you put your money into a CD at 2%, according to the rule of 72?

Consumer Loans: Mortgages and Other Loans

Please reword this paragraph in your own words and please do not use the same exact words as in the paragraph

- 7- The two main types of mortgages are fixed rate and adjustable rate. Fixed rate is exactly that; a consistent rate throughout the mortgage. An adjustable rate or ARM, is when there is a fixed rate for 3-7 years, and then the rate changes in relation to whichever index it is tied to, such as treasury securities. They usually come with caps on how high the rate can rise. An ARM is better for someone who intends to sell the house before the adjustable rate comes into play on the mortgage. HELOCS or home equity loans are taken out of the equity of the house.

Managing Debt

Please reword this paragraph in your own words and please do not use the same exact words as in the paragraph

8- The main purpose of the video was explaining managing and controlling debt by utilizing budget. One thing I liked, it stated to study your budget and figure out what could be adjusted to lower that monthly amount to pay towards debt. Another great tip, is when paying off credit cards; the video suggested looking at the interest rates, and paying off the card with higher interest rates. It also mentioned working on the credit score by continually monitoring your credit and seeing what it is that needs to be attended to or adjusted. This is the good part of credit. In order for our economy and banking systems to revolve, borrowing money and credit cards are good. As long as everyone manages appropriately it will increase the credit and help the banks obtain money to lend to other and put that money into the economy. Also, having a credit score, it allows someone to borrow for a car loan or mortgage; by having a good credit score interest rates are lower and more money can be lent. Paying off credit cards, making payments on time, and making sure at least min amount is being paid; patience is required for the credit score to mature.

"Looking for a Similar Assignment? Order now and Get 10% Discount! Use Code "Newclient"