Managerial Finance

Please submit your assignment with complete answers and show calculations.

*** Submit plagiarism check report with your assignment*** I will do this PART.

Chapter 4 Questions

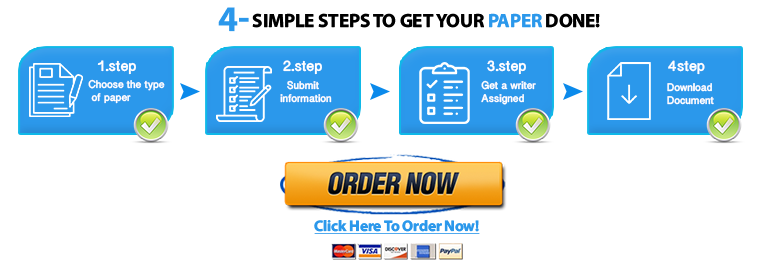

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper Now(4-2) What is an opportunity cost rate? How is this rate used in discounted cash flow analysis,

and where is it shown on a time line? Is the opportunity rate a single number that is used

to evaluate all potential investments?

(4-5) Would you rather have a savings account that pays 5% interest compounded semiannually or

one that pays 5% interest compounded daily? Explain.

Chapter 4 Problems

(4-1) If you deposit $10,000 in a bank account that pays 10% interest annually, how much will

be in your account after 5 years?

(4-2) What is the present value of a security that will pay $5,000 in 20 years if securities of equal

risk pay 7% annually?

(4-6) What is the future value of a 7%, 5-year ordinary annuity that pays $300 each year? If this

were an annuity due, what would its future value be?

(4-7) An investment will pay $100 at the end of each of the next 3 years, $200 at the end of Year

4, $300 at the end of Year 5, and $500 at the end of Year 6. If other investments of equal

risk earn 8% annually, what is this investment’s present value? Its future value?

(4-8) You want to buy a car, and a local bank will lend you $20,000. The loan would be fully

amortized over 5 years (60 months), and the nominal interest rate would be 12%, with

interest paid monthly. What is the monthly loan payment? What is the loan’s EFF%?

(4-16) Find the amount to which $500 will grow under each of the following conditions.

a. 12% compounded annually for 5 years

b. 12% compounded semiannually for 5 years

c. 12% compounded quarterly for 5 years

d. 12% compounded monthly for 5 years

(4-17) Find the present value of $500 due in the future under each of the following conditions.

a. 12% nominal rate, semiannual compounding, discounted back 5 years

b. 12% nominal rate, quarterly compounding, discounted back 5 years

c. 12% nominal rate, monthly compounding, discounted back 1 year

(4-18) Find the future values of the following ordinary annuities.

a. FV of $400 each 6 months for 5 years at a nominal rate of 12%, compounded

semiannually

b. FV of $200 each 3 months for 5 years at a nominal rate of 12%, compounded quarterly

c. The annuities described in parts a and b have the same total amount of money paid

into them during the 5-year period, and both earn interest at the same nominal rate,

yet the annuity in part b earns $101.75 more than the one in part a over the 5 years.

Why does this occur?

(4-19) Universal Bank pays 7% interest, compounded annually, on time deposits. Regional Bank

pays 6% interest, compounded quarterly.

a. Based on effective interest rates, in which bank would you prefer to deposit your money?

b. Could your choice of banks be influenced by the fact that you might want to

withdraw your funds during the year as opposed to at the end of the year? In

answering this question, assume that funds must be left on deposit during an entire

compounding period in order for you to receive any interest.

(4-22) Washington-Pacific invested $4 million to buy a tract of land and plant some young pine

trees. The trees can be harvested in 10 years, at which time W-P plans to sell the forest at

an expected price of $8 million. What is W-P’s expected rate of return?

(4-25) While Mary Corens was a student at the University of Tennessee, she borrowed $12,000

in student loans at an annual interest rate of 9%. If Mary repays $1,500 per year, then how

long (to the nearest year) will it take her to repay the loan?

(4-28) Assume that you inherited some money. A friend of yours is working as an unpaid intern at a

local brokerage firm, and her boss is selling securities that call for 4 payments of $50 (1

payment at the end of each of the next 4 years) plus an extra payment of $1,000 at the end of

Year 4. Your friend says she can get you some of these securities at a cost of $900 each. Your

money is now invested in a bank that pays an 8% nominal (quoted) interest rate but with

quarterly compounding. You regard the securities as being just as safe, and as liquid, as your

bank deposit, so your required effective annual rate of return on the securities is the same as

that on your bank deposit. You must calculate the value of the securities to decide whether

they are a good investment. What is their present value to you?

"Looking for a Similar Assignment? Order now and Get 10% Discount! Use Code "Newclient"